When I hear people complain about interest rates being so high I wonder how low people expect interest rates to go before they realize they are seeing the lowest interest rates in history.

I remember when I looked at purchasing my first house, interest rates were 17%. I didn’t think it was outrageous. That’s what interest rates were in the late 1970’s. Now, interest rates are at an all time low, hovering around 4.5% on a fixed rate loan. I never dreamed interest rates would get so low and stay that way for years on end.

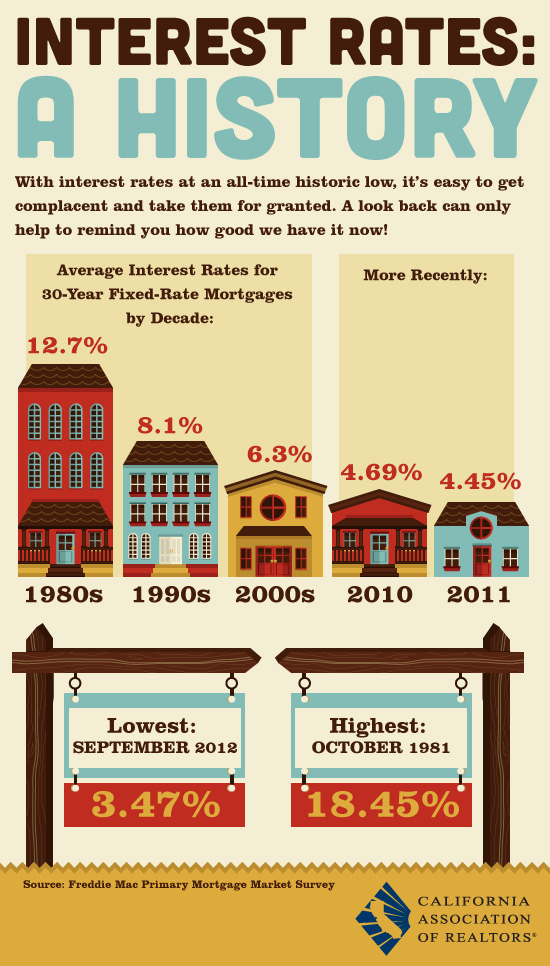

To put it all in perspective, take a look at the chart released by the California Association of REALTORS® from a Freddie Mac Primary Mortgage Market Survey. If you are thinking about refinancing your current mortgage or buying a house or property, now is as good a time as any. I, for one, can not imagine interest rates being any lower. And, think about it – even if they were to go lower, even at 4.5%, you still get a good rate. We can’t have everything, but I’d take a 4.5% interest rate loan any day. And, if some day the interest rates should go lower, well I got mine, and I’m happy for the lucky person who is able to get a rate so low.

Chart used by permission of the California Association of REALTORS.

Chart used by permission of the California Association of REALTORS.

Related articles

- Different types of mortgages explained (*PI* at HubPages.com)

- CBA cuts fixed rates on mortgages (bigpondnews.com)

- Comparing Mortgages (answers.com)

- Mortgage Applications, Interest Rates Fell Last Week (247wallst.com)

A Formula for Calculating Monthly Repayments

on a Mortgage. Sources: AARP; HUD FHA Reverse Mortgages for Seniors (HECM).

There is another way predatory mortgage lenders take advantage

of borrowers; bad lenders structure their loan terms to

make it difficult for homeowners to keep up with

their payments.

LikeLike